Businesses are increasingly prioritizing web accessibility practices to enhance digital activities. By utilizing various techniques like native accessibility features, automated tools, and services, they ensure inclusivity and ADA compliance. Despite affordable solutions, accessibility costs can accumulate annually for businesses.

For this reason, the U.S. government has chosen to promote and support those accessibility practices that comply with the Americans with Disabilities Act (ADA) by incentivizing the efforts made and sustained with a tax credit (a credit is the amount subtracted from your overall liability after you calculate your taxes).

What is the ADA Tax Credit?

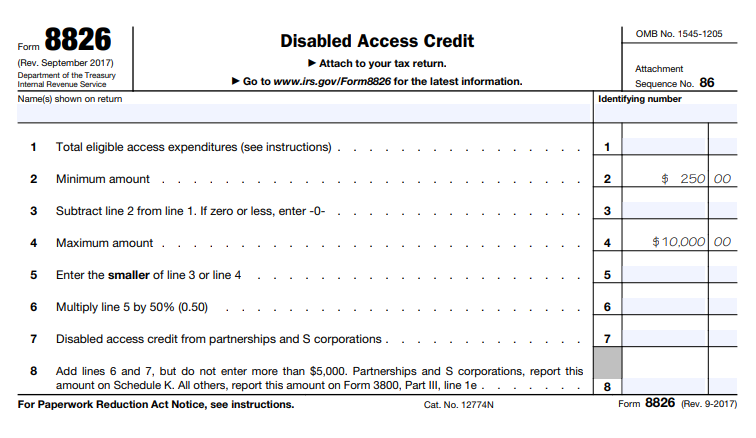

The tax credit, listed under Section 44 of the IRS Code, covers 50% of the eligible access expenditures made during the previous tax year, with a maximum expenditure limit of $10,250. There is no credit for the first $250 of the expenditures, and so, it is subtracted accordingly. Therefore, the highest amount of credit a business can receive is $5,000.

For example, let’s say a business spends $700 on an ADA Compliance remediation service (and that’s its annual accessibility fee). They would subtract $250 from that, which leaves $450. The business is then receiving 50% of what’s left, which equals $225 in credit.

Are you eligible for the ADA Tax Credit?

The ADA tax credit benefit is available to businesses that generated $1,000,000 or less during the year prior to filing or businesses that employ 30 or fewer full-time employees.

Where do accessible websites stand with the ADA Tax Credit?

The ADA was initially drawn up with the intention of applying its rules and regulations to the evolving internet landscape. Currently, the ADA covers websites and does in fact mandate accessibility in the digital arena; this means that the tax credit very much applies to businesses who invest in owning and operating accessible sites.

What stipulations do you need to be aware of?

The good news is that the ADA tax credit can be applied for and earned every year! However, you cannot carry over expenses from the previous year to claim a credit that went over the expenditure limit from the prior year. If the entitled credit amount is more than your tax owed, you can carry over the unused credit to the following year.

The tax credit covers the following accessibility and ADA-related expenditures:

- web accessibility solutions or tools that optimize websites

- the hiring of sign language interpreters

- the purchase of adaptive equipment

- the production of accessible formatting on printed materials (braille, large print, audiotape, computer diskette)

- the removal of architectural barriers in facilities or vehicles

- fees for consulting services

Here’s how to apply for the ADA Tax Credit…

Let’s dive into the application process so you can ensure that you dot your i’s and cross your t’s. First things first, please refer to the Tax Incentives for Improving Accessibility Fact Sheet which provides facts on the tax credit.

Once you have confirmed that your business is eligible, fill out Form 8826 to apply. It must then be attached to your yearly tax return and sent alongside it. You’re able to find Form 8826 on the IRS government website, where you can also research the rules and stipulations regarding the tax credit itself. More instructions can also be found on page 2 of Form 8826. You can also read more on the IRS Tax Credits and Deductions page on the Americans with Disabilities Act website.

Prior to finalizing and submitting your detailed tax return documents, remember to seek advice from a CPA or tax expert. If a CPA firm is unaware of this credit, inform them about form number 8826. This will help them efficiently complete the form and specify the correct amount spent on accessibility initiatives, expediting the process and ensuring accuracy!